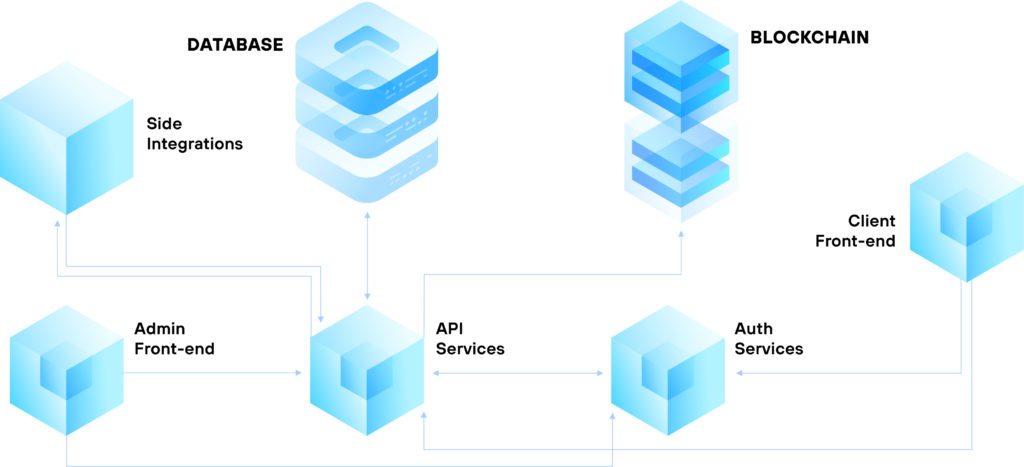

Knox Wire is based on the exchange of secure financial messages, allowing banks and financial institutions to send, receive, inquire and validate information and transactions in real time. Knox Wire works as an international network of financial institutions, connecting Knox Wire participants to to thousands of institutions world-wide.

Knox Wire is based on the exchange of secure financial messages, allowing banks and financial institutions to send, receive, inquire and validate information and transactions in real time. Knox Wire works as an international network of financial institutions, connecting Knox Wire participants to to thousands of institutions world-wide.

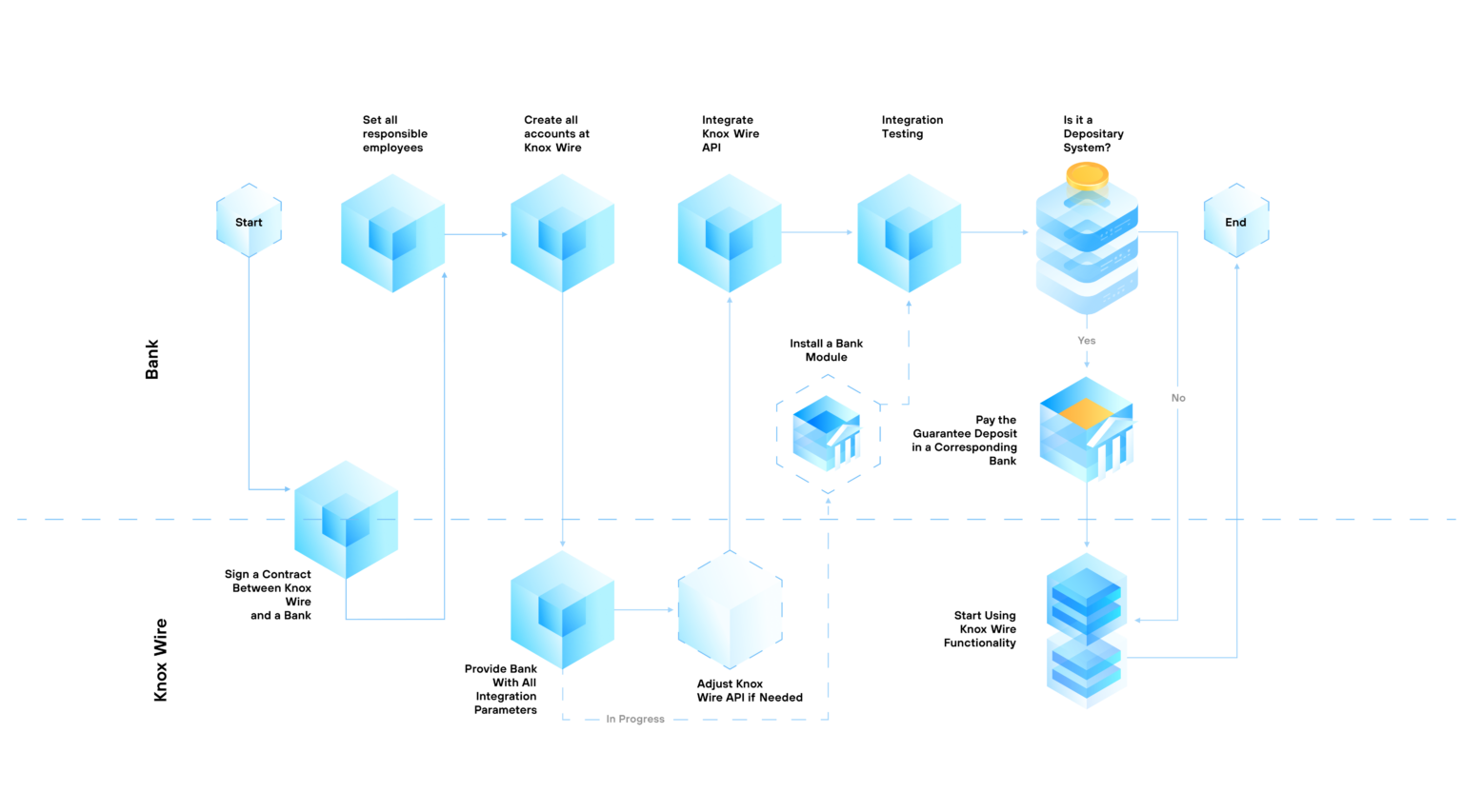

Financial institutions like banks, credit unions, loan associations, investment companies, brokerage firms, insurance companies, mortgage companies, and others can use two functional scenarios:

The core system which requires pre-funding, in most situations, and allows clients to send near instant transactions to all Knox Wire participants and same day transfers to nearly 20,000.

The optional non-deposit system which allows two or more institutions to make an agreement directly to settle at a later date.